1/30/2023M UPTREND Market Falls 2% Waiting for Fed Reserve Announcement Wednesday

THE MARKET’s MESSAGE: Market (QQQ) shows upward strength.

The Investor’s Business Daily’s Big Picture column captured Monday quiet day as it waits for :

The Federal Reserve’s Open Market Committee (FOMC) meets about every 6 weeks when they reveal their outlook for growth of the US economy and inflation. The key for individual investors is the resulting Fed’s moves:

· The Fed is widely rumored that it will increase in the Fed Funds interest rate to slow down the recent economic growth? (Likely but probably a smaller increase than the recent moves.)

· Or will the Fed decide the economy needs to be stimulated with a lower interest rate? (unlikely.)

· But the rumormill predicts a smaller interest rate increase.

At 2 p.m. Wednesday, the FOMC first announcement will be made.

At 2:30, the Fed chair, Jerome H. Powell will take the podium and explain how they see the current market, and market expectations and their position.

Expect the market to be fairly quiet until the 2:00 meeting, and to take off after the 2:30 meeting.

Today’s sell-off on lower volume is a standard indicator of the market’s uncertainty about the Fed’s announcement.

Turn to the ACCUMLATIN/DISTRIBUTION RATINGS of STOCKS table below.

Investors have pumped money into the market recently as shown by the increase in the percent of stocks with “A” and “B” ratings. From the “As + Bs” count of 44% just 4 weeks ago to 62% Monday, indicates the market sees there is more growth to come.

That 18% increase in As + Bs over the last 4 weeks shows some serious and consistent market buying.

Just recently (December 29, 2022), the Ds& Es totaled to a disheartening 37% of all stocks. Today the Ds & Es have dwindled to small 17% (13% "D"s and 4% "E"s.)

The strong ratings and counts shown on the MARKET FACTORS, COUNTS & RATINGS table below, is the result of some wide-spread, serious market buying.

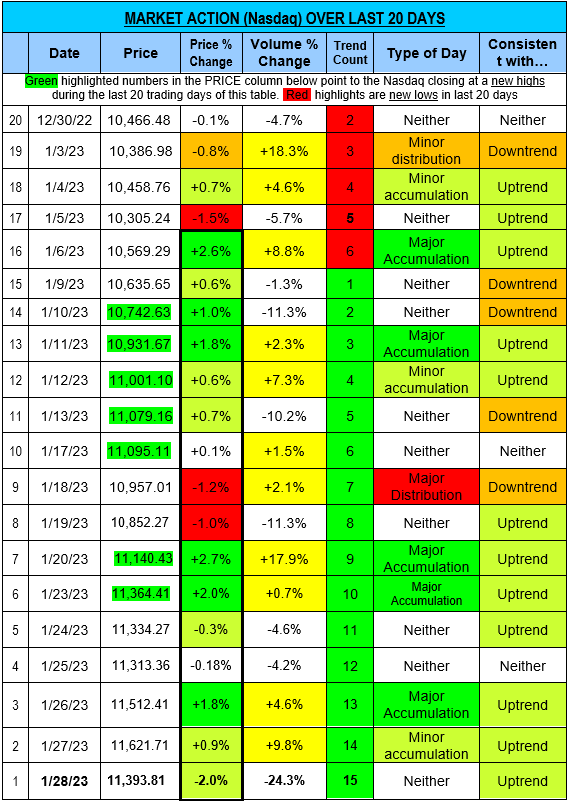

Look at the powerful, recent 18 days with only ONE distribution (sell-off) day. Again, showing the serious market buying over the last 3+ weeks.

>>>>> BOTTOM LINE: This market continues to get STRONGER – I hope you are grinning as much as I am!

Note: When you look at today’s MARKET ACTION table above, scan down the PRICE column and notethe GREEN highlighted prices. They are green because, in the last 20 days, the Nasdaq hit new highs in the last 4 weeks of this chart! THAT’S A LOT OF GREEN.

See you tomorrow.

=========================================================

STOCK WATCHING: Send your suggestion on which stocks to follow in this newsletter. I am looking for just one interesting stock at a time, for training purposes.

Wishing you, “Many Happy Returns.”

CharlotteHudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

###