2/02/2023W Market POPs to 5-month high after Fed Chair Powell gives his comments

THE MARKET’s MESSAGE: Market shows broad UPWARD strength in 2023

Before I go into today’s excellent market, please jump down to the MARKET ACTION (Nasdaq) OVER LAST 20 DAYS table a few pages below and

· COUNT THE NUMBER OF DISTRIBUTION DAYS in the last 20 trading days for the Nasdaq. I’ll wait!

Did you get “1” ? Yes! I don’t remember ever having only 1 down serious day in the last 20! This is a sign ofthe strength of the end-of-year market turn-up! I hope you are not only in the QQQ (or TQQQ, the triple QQQ) but are buying hot stocks as well. But let’s stepback to the Nasdaq.

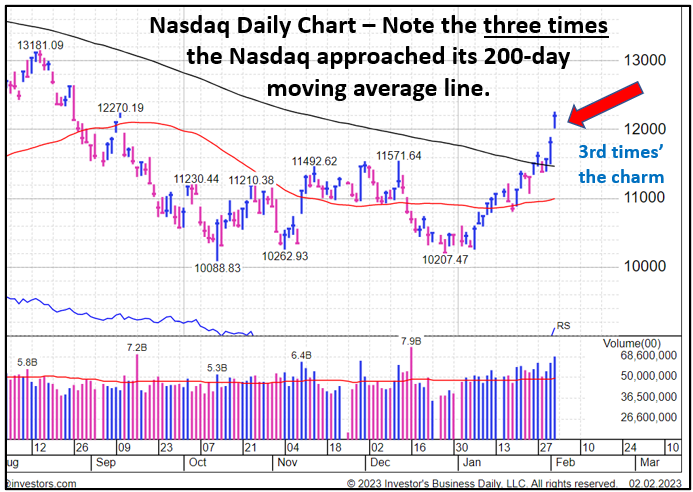

Sometimes it takes multiple runs at a new high. This time, the third try was the winner! It is exciting to see the Nasdaq finally break through its 200-day moving average line and… keep going.

And note, I’ve been pointing out this strong market for a few days getting ready to jump in with a strong signal – closing above the 200-day moving average line 2 days ago was an important signal. But buying a new position was put on hold until we saw what the Federal Reserve would do. When the jumped in and the market opened with a gap up today, I was very excited. But I am an “end-of-day” buyer. So I waited until the market closed. If you saw it happening after the Fed’s announcement, and you bought in earlier, “Bravo.”

Repeating Wednesday’s lesson: My mouth is hanging open! I have never before seen a 20-day period were there was only 1 distribution day. I am almost teared up! This is an amazing Uptrend!

Today’s newsletter was lots of fun to put together! It always is when there is so much good news to share. Isn’t making money a ball!

It is clear the market liked the Federal Reserve’s response Wednesday. Look at the market’s continued runup over the last 2 days!

On the ACCUMULATION/DISTRIBUTION RATINGS table below, note the shift to more and more “A” and “B” stocks points to some aggressive buying of top stocks.

Yesterday, I got excited about the total of As and Bs at 59%. But today, that total jumped to 69% as wild buying takes over the market!

>>>>I am investing in this hot market! And in some great individual stocks. But that is not what this newsletter is about. If you do nothing other than invest in the QQQ at this time, you will be riding a racing car up the hill!

>>>But do not wonder away from the\is hot market – even for a day (if possible.) What flies higher can sometimes run out of gas and dive back to sanity. I know that I will not get out at the top – I only know when to sell after the top is revealed (as I like to say, "When I see it in the rear view mirror!)

If getting a large part of a big run-up is OK with you…. STAY TUNED! That is what this newsletter is good at!

Do you wonder why I sometimes put my comments AFTER the tables and charts? Because I want you to look them over first and make your own conclusions. Then you can read my comments to compare the thoughts. Remember: I am not always right but I do have a pretty good hitting record!

------------------

Moving on to examining the last days, first just soak up all the GREEN!

What’s the message to investors? Yes, you could be in this uptrend swell and be growing your retirement package!

And,again, just to come back to today’s reality, note there is still plenty of upside growth to get back to the previous highs. >>>>> I WILL BE HAPPY TO RIDE THIS MARKET BACK UP TO TOP THOSE PREVIOUS HIGHS!

>>>>> BOTTOM LINE: This market continues to rise, showing strength – I hope you are “riding the rise”and grinning as much as I am!

See you tomorrow.

=========================================================

STOCK WATCHING: Send your suggestion on which stocks to follow in this newsletter. I am looking for just one stock at a time, for training purposes.

Wishing you, “Many Happy Returns.”

Charlotte Hudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

###