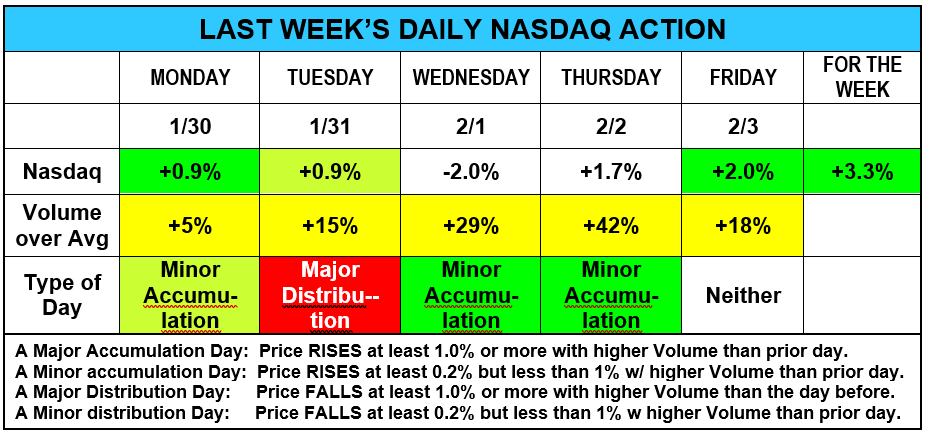

2/03/2023F Market closes the week +3.3% with higher volume!

Note the weekly Nasdaq chart below. I have added blue lines following and extending the price growth. Looking at that chart below, the most recent 6-week gain is the steepest in the 5-years of this monthly chart. I will not be surprised or disappointed after all that growth, if the Nasdaq takes a breather next week. I hope it stays on the top-side of the 200-day line.

This recent rise was the first time since the third week of the 2022 pandemic crash that the Nasdaq has stuck its nose back above its 200-day line. And it did that move with a nice 5-weeks in a row rise. I would not be surprised if the Nasdaq took a breather next week, hopefully holding above that 200-day line.

The Nasdaq closed the week just above 12,000. (Oh, how the traders love those big numbers with all the zeros after them.)

Look back at any monthly Nasdaq chart (marked on the chart) and you will see these wide swings over time. But don’t worry – the market can rely on the general inflation of the economy to keep generating upward growth.

Step back further to a monthly chart with the 2008 low. Can you see that overall rising Nasdaq was just doing what it does so well – out pacing inflation. If you were lucky enough to invest in the Nasdaq near the 2009 low (at $1266), your buy-&-hold portfolio would be 9.5 times as big ($12,007). If you were smart enough to get out of some of those dips (as the downtrend signals indicated),you did much better.

And that is why I prepare this newsletter. Remember,

“The Trend is Your Friend!”

Investor’s Business Daily staff do not take the weekend off (at least not all of them). In fact, they recently posted a Sunday edition of their STOCK MARKET TODAY column with a 20-minute video. The staff warned of a possible market pullback after last week’s big gains. Be sure to watch the market daily!

Please note the tables in the Armchair Investor newsletter are created each day by me (Charlotte Hudgin.) Yes, I do use the extraordinary IBD/MarketSmith charting system. I advise all serious investors to use the IBD/MarketSmith charts.

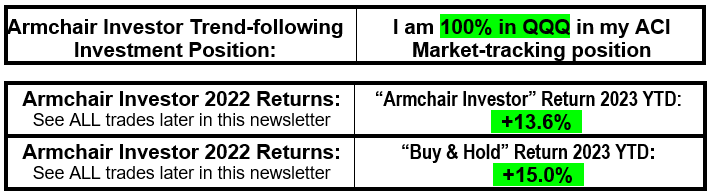

Note the market (as shown above) had a small drop on Friday. But that was after the Nasdaq rose 20% in the last 4 weeks! (I am NOT complaining.)

The following weekly table is only prepared and shown in the weekend Armchair Investor newsletter.

Look at the Accumulation/Distribution A & B ratings grow below! They have risen from 55% of all stocks to 71% in just 4 weeks! WOW!

That’s 71% of all stocks (over $10) had ratings that said they were being widely bought (“A” or “B” ratings). You could throw darts and hit winning stocks.(Not recommended!)

The next table really spills the beans about this market.

>>>Please count the number of distribution days listed below. (answer below the table)

You win if you saw "1" distribution day in the table above!

Congratulations! (I have never see just one distribution day until this market!) What a winning Uptrend!

On the Market Factors table below, note all the GREEN !

Do you wonder why I usually put my comments AFTER the tables and charts? Because I want you to look them over first and make your own conclusions. Then you can read my comments to compare the thoughts. Remember: I am not always right but I do have a pretty good hitting record!

>>>>>BOTTOM LINE: This market continues to rise, showing strength – I hope you are “riding the rise” and grinning as much as I am!

=========================================================

STOCK WATCHING: Send your suggestion on which stocks to follow in this newsletter. I am looking for just one stock at a time, for training purposes.

Wishing you, “Many Happy Returns.”

Charlotte Hudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

###