3/14/20232 Nasdaq pops+2.1% but without volume support.

THE MARKET’S MESSAGE: Nasdaq & S&P500 50-day lines are holding close to their 200-day lines extending sideways action and showing indecision.

FROM MONDAY’S NEWSLETTER: The market signaled a new Downtrend (correction) at the close onFriday.

At the Monday morning open, all three major indexes gapped down. I was glad to have sold at the open as the major indexes stayed down for the first 20 minutes.

Then, the indexes rose, dropped, rose some more, continuing the most volatile day I have seen this year. But cooler heads sold off as the market came close to the end of the day, leaving the Nasdaq up less than 1/2 percent.

Turn back to Monday’s newsletter if you missed how wild the day was.

>>>>>>Note the more volatile price action during Monday’s market compared to the prior days.

On Tuesday, the Nasdaq intraday price action settled down and ended the day up 2.1% closing just above its 200-day line.I hope the Nasdaq and other major indexes will continue rising but do not have any assurance of that outcome. Instead, I have a plan B for what I will do if my “hope” of a rising market does not materialize. I hope you do, too.

>>>>> You should always have a Plan B !

On the weekly chart below....

The Nasdaq ended Tuesday up 2.1%. The S&P500 rose 1.7% and the DJIA continued to be the underdog rising only 1.1%.

ALL THOSE MAJOR INDEXES HAD LIGHTER VOLUME which might be indicating directional uncertainty,

I wait in cash, watching for how the Nasdaq and S&P500 behave Wednesday.

CAN YO SEE THE CHANGE IN MARKET PERSONALITY OVE THE LAST 10 TRADING DAYS BELOW?

On the MARKET FACTORS, COUNTS & RATINGS table below, note there are only 5 GREEN ”Type of Day” boxes. (rightmost column) of UPTREND and the Nasdaq’s A” Accumulation rating and Nasdaq is the only index above its 50-day moving average line (by at least 2%).

Look at the rightmost column ….. and not the change in density of “Downtrend” days in the last 8 trading days, there were 6 days “consistent with” a Downtrend but only 2 days were “consistent with” an Uptrend.

>>>This recent shift to more negative price/volume action shows this is a fairly weak market. Will we see a deep dip next?

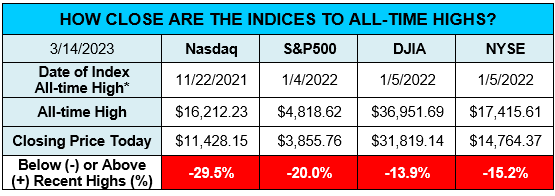

Note In the table below, you will almost always see only red across the bottom row,because as soon as an index hits a new high, if it closes down just 5%, it will show its price below the prior high.

Are you holding onto stocks that you like in spite of their chart action? Not me! Cash is always a safe alternative. But note: With this broad rotation, past highly rated stocks being sold and under rated stocks being bought,) THERE MAY BE AN OPPORTUNITY TO IDENTIFY NEW RISING STARS!

>>>>> When you look at the last 4 weeks of the ACCUMULATION/DISTRIBUTION RATINGS table BELOW, what do you see happening?

Look at the change in percent of A-rated plus B-rated stocks (right most column) over the last 4 weeks! Wow.

Yes! The A and B rated stocks have dropped in half (from 62%to 31%.) That happens when the prior winners are being sold off to take the profits “off the table” and put them in the investors’ pockets.

>>>>>>>>>>>>> PLEASE READ THE FOLLOWING NOTE >>>>>

NOTE: A long time ago, I learned (after paying for this mistake multiple times…..) I finally learned two important lessons:

1. I am NOT smarter than the market. And,

2. The market does not care about my “fine”opinion.

When I see the institutional investors selling hard (as shown by the drop of ”A” and “B” rated stocks, I am happy to step out of the market by selling my QQQ position.

NOTE: If you have individual stocks or ETFs that are holding up well, you certainly can hold them. Butplease keep a tight rein on them.

Remember: Stocks usually fall faster than they rise!

==================

Wishing you, “Many Happy Returns.”

Charlotte Hudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

2023 ACI NEWSLETTER sent via WEBFLOW