3/16/2023H Will the market start a New Uptrend on Friday? Stay Tuned!

THE MARKET’S MESSAGE: The Nasdaq and S&P50 rose significantly over the last 4 days. Is a new Uptrend in theworks?

>>> NOTE:Was Thursday a FOLLOW-THROUGH Day? Not yet, but we may be close!

A Follow-through day signals the start of a new UPTREND,:

· The most powerful Follow-through days occur on days 4 to 7 of an attempted rally. Thursday was day 4.

· Follow-through days can occur as late as day 15, but the later, the weaker the signal

Market strengths/weaknesses as of Thursday:

· Nasdaq rose 4days in a row on above average volume

· But only 1 of those days had higher volume – on Wednesday’s “flat” (+0.1%) day.

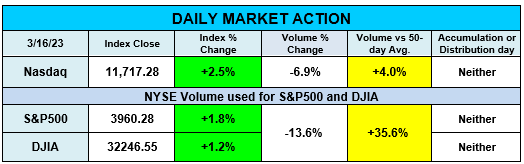

· The Nasdaq rose2.5% on Thursday but on lower volume.

I wonder if the institutional investors are trying to lure us in with a nice jump in price like the Nasdaq’s 2.5% rise? With only average volume I am not buying it!

Look at the chart below and you can count the days in the recent upturn ….. Thursday was the fourth day! But the required enthusiasm of a day of “higher volume” hasn’t hit, yet.

With all the uncertainty in this market, the institutions seem to be hesitating to jump in. If the market hesitates…… so do I.

BOTTOM LINE: I wait in cash, watching for how the Nasdaq behaves tomorrow..

PLEASE SEND YOUR COMMENTS TO EDITOR@ARMCHAIRINVESTOR.COM

On the MARKET ACTION (Nasdaq) OVERTHE LAST 20 DAYS table below, note the message:.

· The last 4 trading days were UP.—but only Wednesday hadhigher volume.

· Thursday’s +0.1% change carries no weight.

· Thus 3 of the last 4 days rise with declining volume –(consistentwith a Downtrend)

NO FOLLOW THROUGH DAY signal yet (whichwould signal a new Uptrend)

· Only one day out of the last 10 was consistent with anUptrend - and that was a down day (its lower volume gave it the Uptrend designation.)

BOTTOM LINE: I wait in cash, watching for how the Nasdaq behaves Friday.

PLEASE SEND YOUR COMMENTS TO EDITOR@ARMCHAIRINVESTOR.COM

On the MARKET ACTION (Nasdaq) OVER THE LAST 20 DAYS table below, note the message:.

· The last 4 trading days were UP.—but only Wednesday had higher volume.

· Thursday’s +0.1% change carries no weight.

· Thus 3 of the last 4 days rise with declining volume –(consistent with a Downtrend)

NO FOLLOW THROUGH DAY signal yet (which would signal a new Uptrend)

· Only one day out of the last 10 was consistent with an Uptrend - and that was a down day (its lower volume gave it the Uptrend designation.)

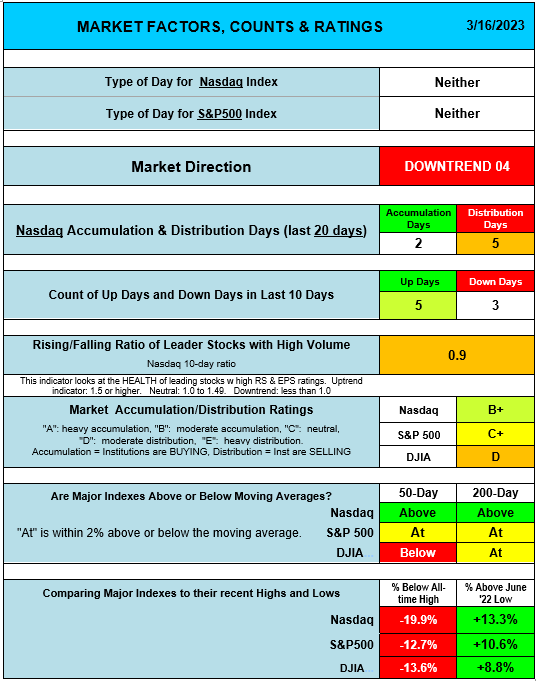

On the MARKET FACTORS, COUNTS & RATINGS table below, there are only 2 GREEN ”Type of Day”boxes. (rightmost column) of UPTREND and the Nasdaq’s "A” Accumulation rating and Nasdaq is the only index above its 50-day moving average line (by at least 2%).

Look at the rightmost column ….. and not the change in density of “Downtrend” days in the last 8 trading days, there were 6 days “consistent with” a Downtrend but only 2 days were “consistent with” an Uptrend.

>>> This recent shift to more negative price/volume action shows this is a fairly weak market.

Note In the table below, you will almost always see only red across the bottom row,because as soon as an index hits a new high, if it closes down just 5%, it will show its price below the prior high.

Are you holding onto stocks that you like in spite of their chart action? Not me! Cash is always a safe alternative. But note with this broad rotation (past highly rated stocks being sold and underrated stocks being bought,) THERE MAY BE AN OPPORTUNITY TO IDENTIFY NEW RISING STARS!

>>>>> When you look at the last 4 weeks of the ACCUMULATION/DISTRIBUTION RATINGS table BELOW, what do yousee happening?

Look at the change in percent of A-rated plus B-rated stocks (right most column) over the last 4 weeks!Wow.

ACCUMULATION/DISTRIBUTION RATINGS of STOCKS

Yes! The A and B rated stocks have dropped in half (from 62%to 31%.) That happens when the prior winners are being sold off to take the profits “off the table” and put them inthe investors’ pockets.

>>>>>>>>>>>>> PLEASE READ THE FOLLOWING NOTE >>>>>

NOTE: A long time ago, (after paying for this lesson multiple times…..) I finally learned two important lessons:

1. I am NOT smarter than the market. And,

2. The market does not care about my “fine”opinion.

When I see the institutional investors selling hard (as shown by the drop of ”A” and “B” rated stocks, I am happy to step out of the market by selling my QQQ position.

NOTE: If you have individual stocks or ETFs that are holding up well, you certainly can hold them. But please keep a tight rein on them.

Remember: Stocks usually fall faster than they rise!

==================

Wishing you, “Many Happy Returns.”

CharlotteHudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

2023 ACI NEWSLETTER sent via WEBFLOW