2/10/2023F Uptrend day 23, Nasdaq has First Down Week in7 weeks

THE MARKET’s MESSAGE: Nasdaq slowly dips lower. Volume lighter.

The Nasdaq is up 12.0% in the first 6 weeks of 2023. Yes, that is after the index dropped 4.0% last week. But I still am NOT going to complain about the Nasdaq 12% gain this year. I still suspect that the big market players dipped the market back to near its October 2022 low, so it could create excitement as it took off in January. It certainly got my attention!

Today, I want to walk you through the ups and downs of the market from its all-time high in November 2021, to today.

In Thursday’s newsletter, I pointed out the three times the Nasdaq attempted to reverse the 4+ quarter fall off its all-time high. If you are an analytical type, today’s discussion should tickle your numbers side. If not, consider there are valuable lessons in becoming a better market Sherlock Holmes -- staying in this conversation may give you some useful skills.

Below is the weekly view of the Nasdaq from its all-time high to today.

Can you see what is notable on the chart below? No looking ahead at the answers! The numbers below refer to the ellipses on the chart below them as shown on the number 1. Before you read my key to each number, can you see why each place on the chart is worthy of a notation?

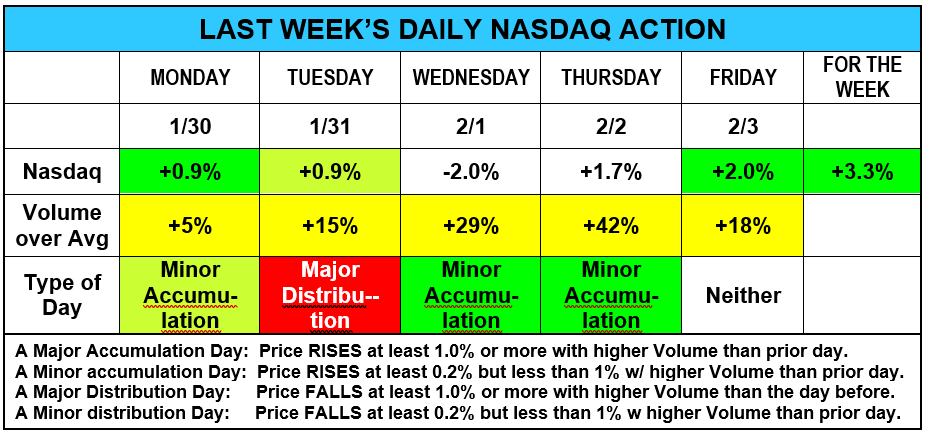

Explanation of each numbered circle (ellipse) above are shown after the "LAST WEEK'S DAILY NASDAQ ACTION" table below.

Here are the explanation of what I saw at each point above.

ANSWER TO THE DATA POINTS:

#1 10 rising days in a row – and the last 8 days were all in new high territory andhad very high volume on each day (especially the first 3 rising days.) We call that high volume all the way up “irrational exuberance.”

#2 Nasdaq fell below its 200-day moving average line – and stayed below for over a year.

#3 The 50-day moving average line crossed below the 200-day line and has not yet returned above it.

#4 The Nasdaq approaches its 200-day line and is rebuffed back down.

#5 After slicing beneath its 50-day line, the Nasdaq reverses back upward but is rebuffed from that line also.

#6 After almost 3 months, the Nasdaq closes above 50-day line on its second try.

#7 Nasdaq attempts to rise back to 50-day line,but note the low volume on the final 2 rising days showing the market was out of steam.

#8 After smashing back down through its 50-dayline, the Nasdaq made a pathetic 4-day rise, closed for 2 days slightly above that resistance line and then gapped down below the next,closing 5.2% down on the second day at the bottom of the day’s range.

#9 After scraping the 10,200 low for a quarter,we enjoyed a 20.2% rise to kick off the new year. Was that timing just luck? I suspect the big players kept the market low for the last quarter so the first quarter of this year would be exciting!

>>>> If you found the above exercise interesting, please let me know. All comments are always welcome –send to editor@armchairinvestor.com

On to 2023:

Focusing on the most recent two weeks (below), note the attempted rise last week, when fizzled badly this past week.The market still leaves the Nasdaq up 12.0% for 2023 with an exciting “A” Accumulation/Distribution rating indicating some serious buying this year.

The following year-to-date table is included weekly for your reference. These returns have little relevance to trend-following returns since trend-followers do not hold during “Downtrends”and may lighten their holdings during “Uptrends under Pressure.” You might like it as a scorecard for their results year-to-date.

On the MARKET FACTORS table below, the only red is at the bottom – showing how far the major indexes have risen above their end of 2022 highs.

NOTE for NEXT WEEK:The stock market will have a 3-day weekend for the Presidents Day Monday holiday on 2/20/2023

>>>>> BOTTOM LINE: This market continues to rise, showing strength – I hope you are “riding the rise”and grinning as much as I am!

=============================================================

STOCK WATCHING: Send your suggestion on which stocks to follow in this newsletter. I am looking for just one stock at a time, for training purposes.

Wishing you, “Many Happy Returns.”

Charlotte Hudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

###