3/08/2023W Market listens to Fed Chair’s comments and Nasdaq closes +0.4%

THE MARKET’s MESSAGE: Nasdaq & S&P500 50-day lines are holding close to their 200-day lines extending sideways action, showing indecision.

We had no choice but to wait to see what the Fed Chair’s final comments about the economy would be today and how the market would react to them.

Investors.com reported in tonight’s BigPicture column that Powell's comments on Tuesday and Wednesdaysignaled that the U.S. central bank is now mulling over the possibility of therecent quarter-point rate hike may not be enough to accomplish the difficult mission of getting inflation back down to a 2% long-term target. Yikes! I guess we all have to hang on for the moment!

YEAR-TO-DATE ARMCHAIR INVESTOR 2023 QQQ RETURNS UPDATE

In case you missed the weekendyear-to-date summary, here is that recap:

(Spoiler: THE QQQ IS A VERY GOOD PLACE TO BE (at the moment.)

The Nasdaq and Nasdaq100 (ticker QQQ) have outperformed the other major Indexes, as usual in an Uptrend – see chart below. The QQQ is where I usually have my “Market Following” position. And I’m glad to be in the QQQ (See why below this table.)

As I noted Monday night, the Nasdaqindex is outperforming the S&P500 by more than a factor of 2 to 1 this year! And the index continues riding above its 50-day moving average red line.

By the end of Wednesday’s market, theQQQ had risen almost 12% this year, just a smidge under 3 times the 4.0% the S&P500 has earned this year.

How did the market take Powell’s warning about a tight employee pool which could push up costs? That first quarter return for the QQQ is amazing! (I am not counting on that return each quarter this year. But I will happily ride it as long as it continues!)

Have you ridden the QQQ for this year to grab that 11.8% current gain? Or maybe you are good enough to have exited with a bigger gain at the start of February. As long as you have been in the market since early in the January pop, you should be in good shape!

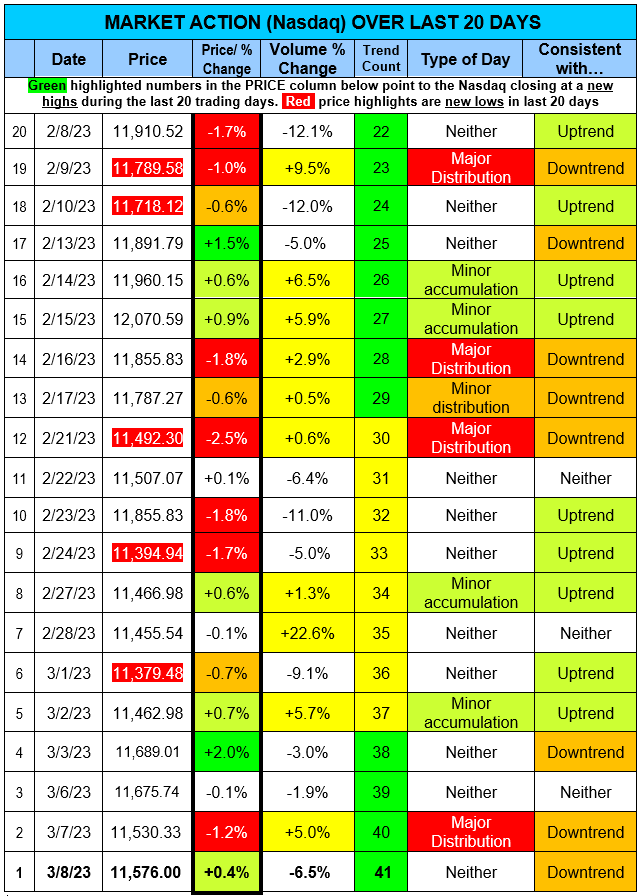

On theMARKET ACTION table and the FACTOR, COUNTS & RATINGS table below note:

· The last 8 trading days (shown in the table below) have only 2 accumulation days and only 1 distribution day (yesterday!).

>>>>> Those low counts mean 7days were neither accumulation (buying) days or distribution (selling) days showing INDECISION about the health and future of this market. So please stay with me each day -- it is possible the Nasdaq could dive back under its 200-day and 50-day average lines (they are almost at the same price tonight.

An additional note:

· There is a divergence between the three major indexes and their level of their being bought and sold – as shown by the IBD Accumulation/Distribution ratings:

On the MARKET ACTION table below note:

· The last 11 trading days (shown in the table above) have only 2 accumulation days and only 1 distribution day (today!).

>>>>> Those low counts mean 8days were neither accumulation (buying) days or distribution (selling) days showing INDECISION about the health and future of this market.

On the MARKET FACTORS, COUNTS & RATINGS table below, note there are few GREEN boxes –Market Direction of UPTREND and the Nasdaq’s "A" Accumulation rating and Nasdaq is the only index above its 50-day moving average line (by at least 2%),

Note: In the table below, you will almost always see only red across the bottom row, because as soon as an index hits a new high, if it closes down just 5%, it will show its price below the prior high.

Are you holding onto stocks that you like in spite of their chart action? Not me! Cash is always a safe alternative. But note with this broad rotation (past highly rated stocks being sold and under rated stocks being bought,) THERE MAY BE AN OPPORTUNITY TO IDENTIFY NEW RISING STARS!

When you look at the last 4 weeks of the ACCUMULATION/DISTRIBUTION RATINGS table BELOW, what do you see happening?

>>>>>You should notice the percent of top rated stocks (A or B rated stocks) has declined – ALMOST IN HALF while the D and E rated stocks have DOUBLED. That tells you there is a ROTATION going on.

NOTE: A long time ago, I learned (after paying for this lesson multiple times…..) I learned twoimportant lessons:

1. I am NOT smarter than the market. And,

2. The market does not care about my “fine” opinion.

==================

CharlotteHudgin, The Armchair Investor, (214)995-6702

www.ArmchairInvestor.com (214)995-6702 editor@armchairinvestor.com

2023 ACI NEWSLETTER sent via WEBFLOW